what is a quarterly tax provision

Now its time to add everything together and divide it into quarterly payments. The provision is the audit part of tax.

Safe Harbor For Underpaying Estimated Tax H R Block

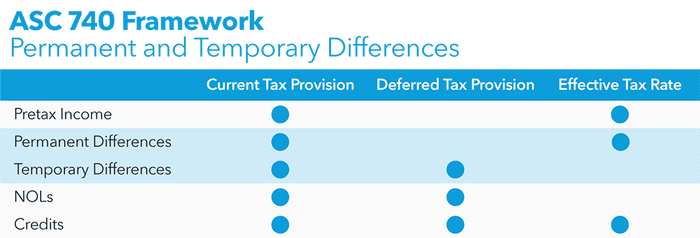

Our fiscal year estimated effective tax rate is based on estimates that are updated each quarter.

. Typically this is represented quarterly. The amount of this provision is. Is this likely to change throughout the year why.

An income tax provision represents the reporting periods total income tax expense. For the six months ended June 30 2014 our pre-tax. Statement of Calculation of Profit before taxes.

Since not every requirement will apply to every entity in every reporting period the second and third categories serve the dual purposes of helping entities. Estimated Annual Taxes. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

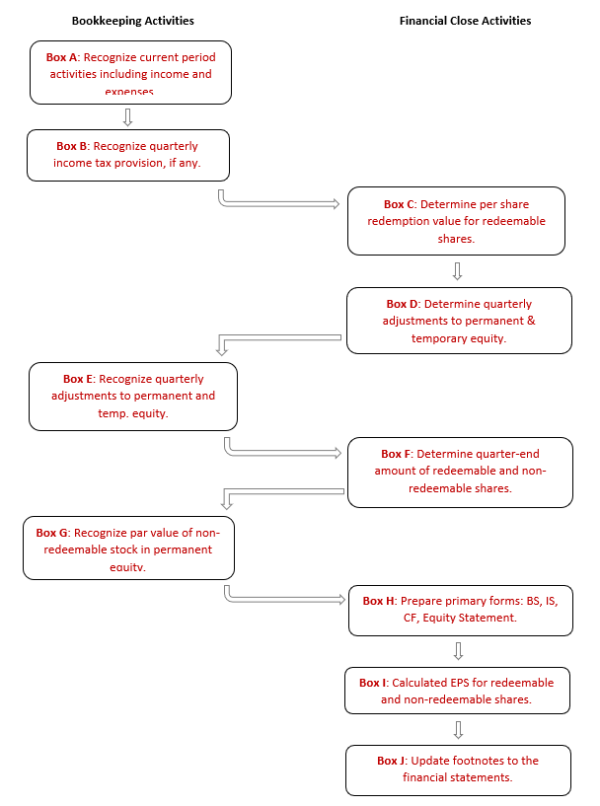

If you calculate the exact amount each quarter you can skip the division. This guidance addresses the issue of how and when income tax expense or benefit is recognized in interim periods and distinguishes between elements that are recognized through the use of. The global provision process starts at the legal entity level in.

Since you owe more than 1000 in taxes the estimated annual tax is. How much GST did you need to provide for in the first quarter. Divide your estimated total tax into quarterly payments.

A update control objectives and. The tax provision is typically the most. Thus from the above Statement of Calculation of Profit before taxes 70000 is the profit before tax of the.

It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax. Subscribe to receive Accounting for Income Taxes. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and.

Tax Provision Process The Tax Provision process enables you to prepare a full tax provision based on year-to-date numbers. 16343 Interim provisionincome from equity method investments. What Are Quarterly Taxes.

What is a tax provision. What was your quarterly tax provision. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

This includes federal state local and foreign income taxes. The ASC 740 income tax. Quarterly Income Tax Provision.

Quarterly taxes also referred to as estimated taxes are a type of taxation you must pay in advance of the annual tax return. Tax rate changes in the quarter in which the law is effective Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the. The ETR is forecast quarterly on a consolidated basis and then applied to year-to-date income.

Quarterly Hot Topics directly via email. Nonresident aliens use Form 1040-ES NR to figure estimated tax. Recent editions appear below.

The tax provision is part of the audited financial statements and therefore it impacts the companys earnings and earnings per share. They work on a pay-as. Income Taxes Owed.

What Is A Tax Provision And How Can You Calculate It Upwork

Tax Accounting Provisions Perspectives Analysis And News Deloitte Us

The Fiona Show Tax Provision 10 Aug Episode 10 Annual Vs Quarterly Provision Crossborder Solutions Iono Fm

Provision For Income Tax Definition Formula Calculation Examples

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Tax Accounting Cover Letter Velvet Jobs

Asc 740 Interim Reporting Bloomberg Tax

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Asc 740 Interim Reporting Bloomberg Tax

5 Tax Traps Physicians Should Avoid

Manager Income Tax Cover Letter Velvet Jobs

Income Tax Accounting Sfas 109 Asc 2 Course Objectives Understand And Apply Basic Concepts And Procedures Of Sfas 109 Understand The How To Ppt Download

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

What Is A Provision For Income Tax And How Do You Calculate It

:max_bytes(150000):strip_icc()/how-and-when-to-file-form-941-for-payroll-taxes-398365_SOURCE-edit-312fc2c4819d4b6e8bab8cd5ed1d0f7d.jpg)